How Delaware Statutory Trusts Work. Delaware Statutory Trust Ownership.

Delaware Statutory Trusts 1031 Exchanges Accelerated Wealth

Delaware Statutory Trusts 1031 Exchanges Accelerated Wealth

Develop the ability to assess investment opportunities and increase your portfolio value.

Delaware real estate investment trust. The real estate sponsor firm which also serves as the master tenant acquires the property under the DST umbrella and opens up the trust for potential investors to purchase a beneficial interest. By understanding a few details about the basic structure of DSTs we can see how they come to have the beneficial features that they do. A Delaware Statutory Trust DST allows accredited investors to receive potential rental income diversify their equity and defer capital gains tax.

72 of retail lose money. The investors may either deposit their 1031 Exchange proceeds into the DST or purchase an interest in the DST directly. The Delaware Statutory Trust enables a real estate investor to maintain an investment position in real estate without the personal management responsibilities.

One City Boulevard West Suite 870 Orange CA 92868 7051 Heathcote Village Way Suite 200 Gainesville Virginia 20155 Delaware Statutory Trust DST investments are subject to subject to the various requirements and restrictions of Section. Delaware Statutory Trusts DSTs provide real estate investors with a way to invest passively in commercial real estate. Kingsbarn as a sponsor of DSTs acquires high-quality commercial income properties places non-recourse financing on the properties and retains a national third-party property and asset management firm to manage the properties and make monthly distributions to all investors.

Buy and Sell ETFs Online. A Delaware Statutory Trust is a legal entity designed to hold institutional investment real estate that is actively managed by professional real estate firms. The Delaware Statutory Trust DST is a legal entity created and often used in real estate investing that allows for a number investors to pool money together and hold fractional interests in the holdings and assets of the trust.

Put Real Estates Unfair Advantages to. The trust is established by a DST sponsor who first identifies and acquires the real estate assets. Anzeige Explore various types of alternative investments from private equity to real estate.

Access numerous financial markets from one place. The Deferred Sales Trust allows a real estate investor to sell a highly-appreciated property and defer the payment of capital gains taxes. 72 of retail lose money.

More recently Revenue Ruling 2004-86 determined that a Delaware Statutory Trust qualified as real estate and as such could serve as a replacement property solution for 1031 Exchange transactions. DSTs allow individual investors to perform a tax-deferred 1031 Exchange into a beneficial interest of the trust also referred to as a fractional interest in a larger property or portfolio of multiple properties. Access numerous financial markets from one place.

Delaware Statutory Trusts DSTs are useful in real estate investing in large part due to their particular legal characteristics. Buy and Sell ETFs Online. A Delaware Statutory Trust DST is an investment property ownership structure where multiple investors each hold an undivided fractional interest in the holdings of the trust.

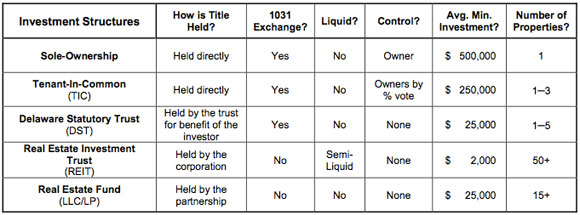

Similar to the Tenant-In-Common structure the Delaware Statutory Trust DST provides a means of real estate ownership that is undivided fractional and compatible with the 1031 1033 and 721 tax-deferred exchanges. Real estate investors who want the tax benefits of a 1031 exchange without the responsibilities of management might consider the Delaware Statutory Trust.

Delaware Statutory Trusts Vs Real Estate Investment Trusts

Delaware Statutory Trusts Vs Real Estate Investment Trusts

Real Estate Investment Structures Jrw Investments

Real Estate Investment Structures Jrw Investments

Delaware Statutory Trust For Real Estate Investors Royal Legal Solutions

Delaware Statutory Trust For Real Estate Investors Royal Legal Solutions

Dst Real Estate Investments 1031 Exchange Kingsbarn Realty Capital

Dst Real Estate Investments 1031 Exchange Kingsbarn Realty Capital

Modern Real Estate Investing The Delaware Statutory Trust Book 969

Modern Real Estate Investing The Delaware Statutory Trust Book 969

Passive Real Estate Investing With A Delaware Statutory Trust Dst Kiplinger

Passive Real Estate Investing With A Delaware Statutory Trust Dst Kiplinger

Modern Real Estate Investing The Delaware Statutory Trust By Mbt Trawnegan Gall Harvey Cpa David Kangas Paperback Barnes Noble

Modern Real Estate Investing The Delaware Statutory Trust Book 969

Modern Real Estate Investing The Delaware Statutory Trust Book 969

Delaware Statutory Trust Guide Real Estate Transition Solutions

Delaware Statutory Trust Guide Real Estate Transition Solutions

Using A Delaware Llc For Real Estate Investment Harvard Business Services

Using A Delaware Llc For Real Estate Investment Harvard Business Services

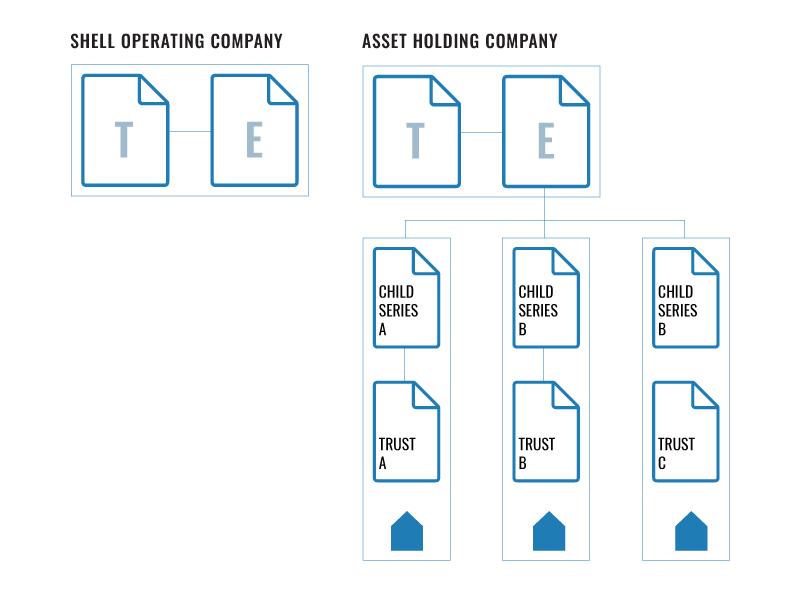

Eu Parallel Structure For An Us Real Estate Fund Fundset Case Study

Eu Parallel Structure For An Us Real Estate Fund Fundset Case Study

Real Estate Tip 1031 Delaware Statutory Trusts Kiplinger

Real Estate Tip 1031 Delaware Statutory Trusts Kiplinger

Modern Real Estate Investing The Delaware Statutory Trust

Modern Real Estate Investing The Delaware Statutory Trust

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.